Description

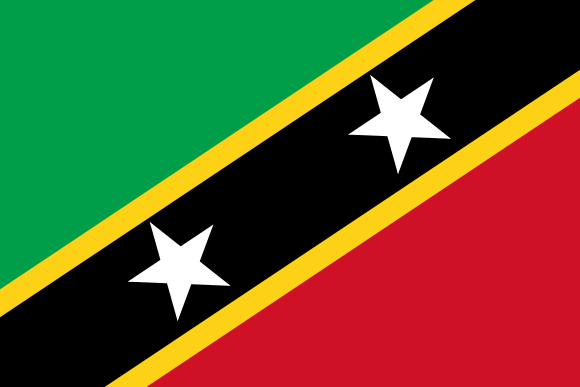

Nevis

The so-called Nevis Corporation was established by the Nevis Business Corporation ordinance of 1984 and is described by many international lawyers as the most flexible offshore centre

The features of a Nevis Corporation are based on British company law

- Strict confidentiality of economic ownership

- Tax exemption at large and no currency control

- No financial or annual reports that have to be submitted

- No residence obligation for directors

- Main files and office can be located outside Nevis

- No income taxes, social security contributions, capital gains tax with holding and stamp taxes

- There are no gift, death, dividend, distribution or inheritance taxes

- There is no need for a business licence

- The names of directors and members will not be published

- Civil lawsuits become time-barred after one year