Seychelles IBCs were created by the International Business Companies Act of 1994. Nowadays this jurisdiction is very popular due to its simplicity, its swift start-up procedure and its price, but it also offers many other advantages as you may see below.

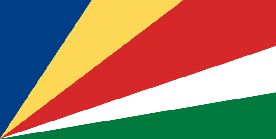

Seychellen

Seychellen

- In the Seychelles, IBC do not pay any other taxes than a public licence fee

- Annual reports (accounting, audits) are required for any IBC

- Shares can be registered or unregistered (bear)

- Shares may be issued with or without a par value

- Just one shareholder and one director are required. Their personal details will not be published. Besides we can offer a specific shareholder service

- Shareholders, directors and executives do not need to be residents of Seychelles and there is no provision as to their nationality

- Directors or senior executives may be companies or natural persons

- There is no foreign exchange control

- It only takes 24 hours to establish a offshore company in Seychelles

- Swift incorporation and administration processes

- Shareholders and directors meetings that cannot be held on Seychelles may be conducted by telephone

- The articles of incorporation is the only document that needs to be kept in a public register

- Announcements as to the beneficial owner have to signed by the beneficial owner and sent to the registered agent. This is not intended to be registered publically but must be saved by the registered agencies

- IBCs may do business in any country and in any currency.