Description

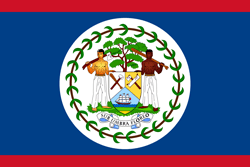

Belize IBC

Offshore legislation of Belize is modern and up to date, offering maximum flexibility in asset protection and tax and investment planning

Trade and business outside Belize

- Tax exemption, no local taxes, no payment of stamp duties on transactions related to shares, debt securities or other bonds

- No exchange with other authorities

- No need for disclosure of beneficial owners, bearer shares are permitted. Protection against exchange with foreign authorities.

- Security and confidentiality

- Just the memorandum and the articles of association are needed.

- No minimum capital required, no audit of the annual financial statements, no deposit of annual return, just one shareholder and one director, who may be a legal person. Meetings can be held outside Belize and shareholders may participate by telephone or other electronic means.

- Shares can be issued with or without par value

- Registration in any foreign language admitted