Description

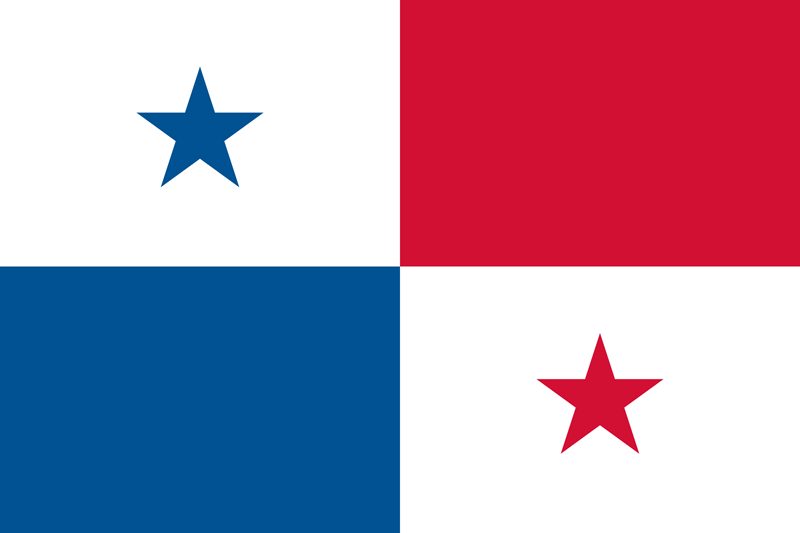

Panama

For more than eighty years, Panamanian Sociedad Anonima SA has been recognized worldwide as a company vehicle that can be successfully used in a variety of international asset protection real estate planning structures, among other things.

Special features of Panamanian Sociedad Anonima SA

Foundation in 24-48 hours

Panamanian companies may act without reference to the nationality of their directors and shareholders.

Income generated by a Panamanian entity outside the Panamanian territory is tax-exempt

Approved capital does not have to be paid in full or in part

There is no need to file financial reports or tax returns with a government agency in the Republic of Panama unless the company receives revenue from Panamanian sources

Legal entities of the decision-makers may be appointed as directors and shareholders of a Panamanian Sociedad Anonima SA

There is no need to hold annual meetings of directors or shareholders

Directors and shareholders may hold meetings in person by proxy or other electronic means

Three directors are either natural or legal persons

Shares can be issued to the holder The name of the shareholder is not required to be entered in the Panamanian public register

A company can make transactions and hold assets in any part of the world.

Panamanian companies are legally authorized to perform lawful acts around the world

No exchange with other authorities